Collection: Products

-

HDPT Eco Tote Bag

Regular price $29.99 USDRegular priceUnit price / per -

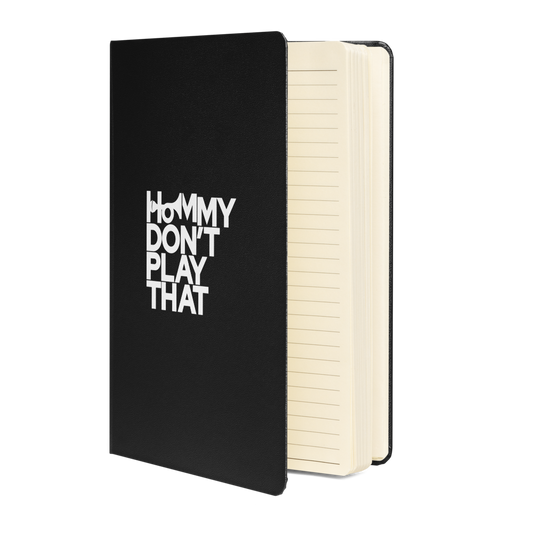

HDPT notebook

Regular price $21.99 USDRegular priceUnit price / per -

HDPT-shirt (Adults/Unisex)

Regular price $28.99 USDRegular priceUnit price / per -

HDPT-shirt (Youth)

Regular price $24.99 USDRegular priceUnit price / per

What Is a 529 Plan?

As the cost of higher education continues to rise and the problems of many Americans spending much of their adulthood mired in student debt is readily apparent, many are turning to tax-advantaged 529 savings plans to help fund their children's education. Named after Section 529 of the Internal Revenue Code (IRC), these plans were originally designed to cover postsecondary education costs.

Their scope has greatly expanded in the last decade. In 2017 and 2019, respectively, Congress passed legislation allowing 529 plans to cover the costs of K-12 education and apprenticeship programs. Later, the Setting Every Community Up for Retirement Enhancement (SECURE) Act of 2019 and the SECURE 2.0 Act of 2022 permitted 529 funds to be used for student loan repayment and Roth IRA contributions.

There are two main types of 529 plans:

- Education savings plans and prepaid tuition plans. Education savings plans offer tax-deferred growth, and withdrawals are tax-free when used for qualified education expenses. These plans remain under the control of the donor, usually a parent.

- Prepaid tuition plans enable account owners to lock in current tuition rates for future attendance at selected colleges and universities. Given the rising costs of tuition, this generally means locking in lower prices for college later on.

Despite their advantages, the Education Data Initiative estimated in 2023 that only about 30% of American college savings are held in 529 accounts. Nevertheless, those who do use them contribute an average of over $7,500 annually.